Investment Process

The Merlon process is simple: we invest in undervalued companies where we think market participants have become too pessimistic.

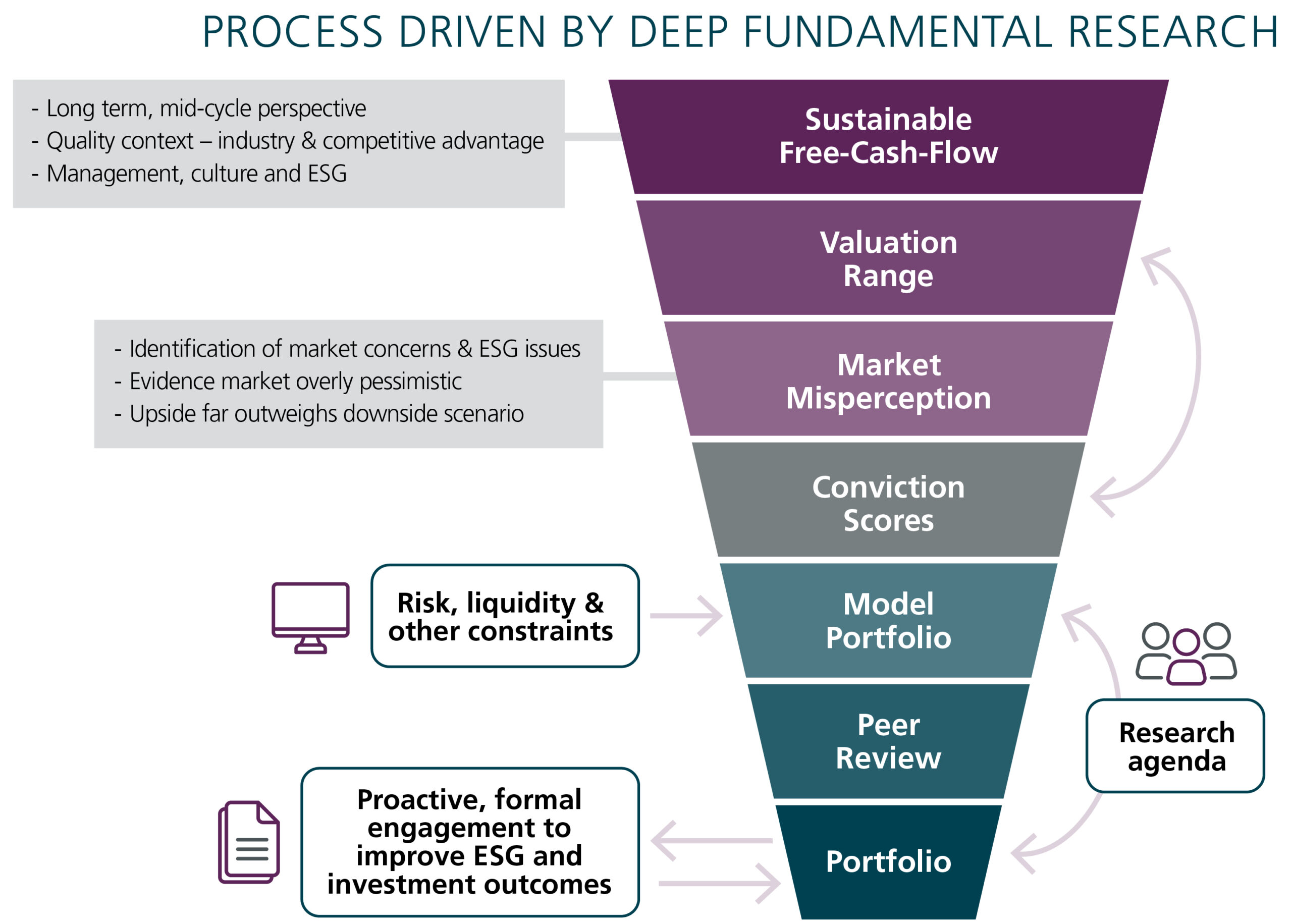

Our process is aimed at ensuring we invest in a manner consistent with our philosophy. Along these lines, we seek to identify and exploit misperceptions about risk and future growth prospects. At the same time, we seek to minimise our exposure to behavioural vulnerabilities and maximise our productivity:

- If a stock appears “cheap” relative to an unbiased and consistent measure of value, then there is some chance that other investors have become too concerned about risks or too pessimistic about future growth prospects.

- Our attention then shifts to understanding why other market participants are concerned or pessimistic. To be a good investment, we need evidence that these concerns are either priced in or invalid. The expected return on the investment also needs to be acceptable relative to the risk of permanent capital loss. We incorporate these aspects with a “conviction score”.

- Our valuation signals and conviction scores are combined to create a model portfolio. The model portfolio is constantly mapped against the live portfolio to generate trade ideas subject to a formal peer review process.

ESG and Engagement is fully integrated throughout our investment process. Click here for more information.