Oil – Pricing in More Realistic Recovery

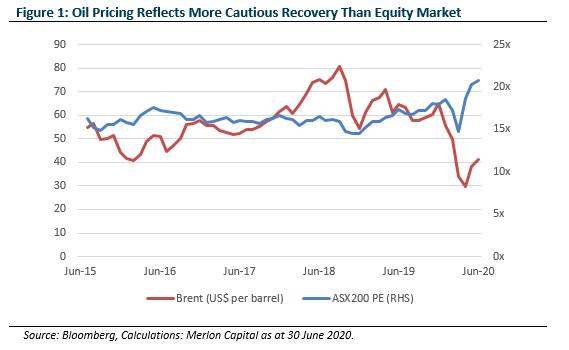

Even with the bounce of more than 100% from March lows to USD43/bbl, oil prices reflect a more realistic view of the difficulty restoring economic activity to pre-COVID levels than the broader equity market and other key commodities (see below). For this reason, oil equities have a better risk-reward skew than the broader market, whether lockdowns are reinstated, or a V-shaped recovery transpires. In addition, medium-term supply/demand dynamics result in an upside risk bias.

We explore the outlook for oil and related equities in this paper, with the key points being:

- The recovery in oil demand is underway, albeit at a slower pace than initially anticipated.

- US Shale supply is at a tipping point. Capital had become more disciplined and rigs had been declining pre-COVID. Weaker near-term demand should see this continue but at the same time, any price spikes are likely to see US supply at least partly restored.

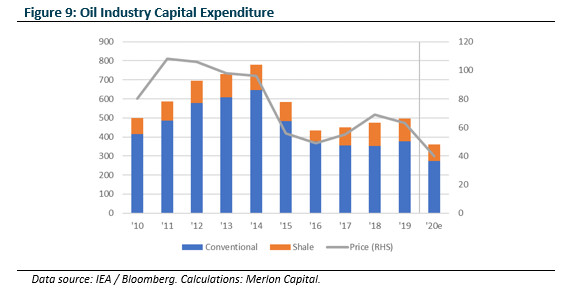

- Years of underinvestment in conventional oil underwrite higher oil prices long-term.

- There is a disconnect between low oil prices and the broader equity market, with the former implying a protracted recovery and the latter a V-shaped recovery. Investing in oil equities therefore provides downside protection should the recovery be more drawn out,

- For similar reasons, oil also has a superior risk reward skew to iron ore in our view.

Demand recovers to 10% below normal

Initial estimates on the impact of the pandemic were for oil demand to trough in April, following the globally co-ordinated social distancing measures introduced. Demand was estimated to trough 15% below baseline levels of 100mbpd and recover to be only 5% lower in 2020 as lockdown measures were eased. With cases yet to peak in emerging economies and parts of the US, current estimates now have demand 7.5% lower in 2020, with recovery pushed out into 2021.

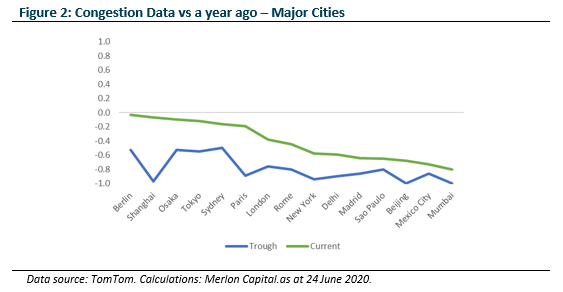

Analysing available data on traffic congestion levels in major cities does provide some indication of the shape of the recovery to date. From real-time TomTom data, we can see that global congestion levels have recovered roughly half of the activity lost at the peak of lockdowns. The question now is how disrupted the path to recovery from here will be given the effects of relaxing social distancing measures. Medium term recovery will likely depend on achievement of herd immunity and / or vaccine(s) development.

Supply

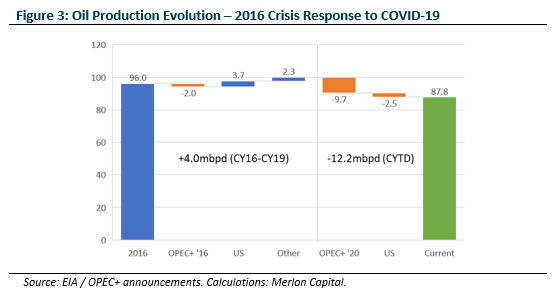

During the 2014-2016 crisis in oil markets, oil prices touched USD27/bbl, and a newly expanded OPEC+ cartel reached a previously-unthinkable agreement to reduce production by 1.6mbpd. By 2020 this agreement had evolved into an even larger cut of 2.0mbpd, or 2% of global oil production. This collective action, despite a volatile phase as the agreement rolled off in March, was enacted once again, with the OPEC+ group agreeing to cut by 9.7mbpd in response to the rapid impact of COVID-19 on demand, as can be seen below.

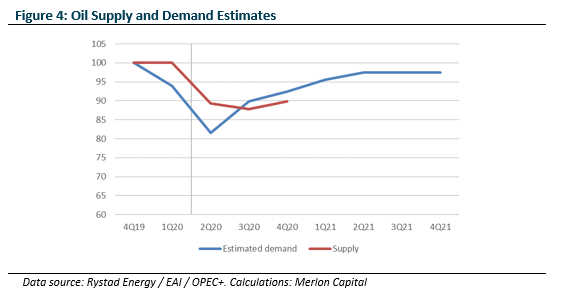

The question from here, is how successful these cuts in supply are in addressing the declines in demand. The chart below is an estimate of the path of demand over the course of 2020 and beyond. Should demand recover as currently modelled, then global oil markets should be moving into a deficit in the second half of 2020.

The objective, once the market has been stabilised, will then be to work off inventory build over the first half of the year. OPEC has estimated an inventory build to date of 1.3b barrels, more than three-times the 2014-16 level. Given this, it is likely that the OPEC+ production agreement will be extended, notwithstanding any rebound in US onshore volumes.

The future of shale

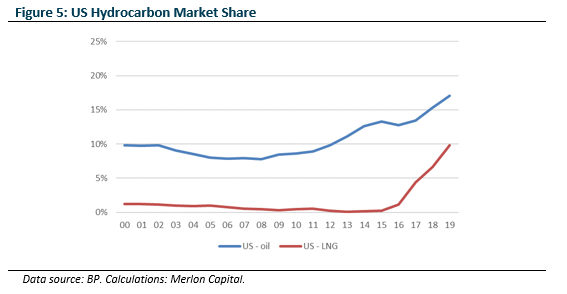

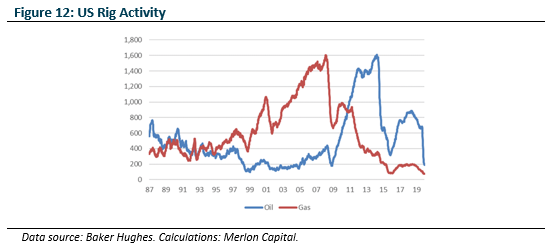

Given the scale of the impact on global oil markets, it is worth assessing the effects on the US unconventional oil and gas industry. Over the past decade, the rapid growth in unconventional oil and gas production has seen the US as a key disruptor of global oil and gas markets.

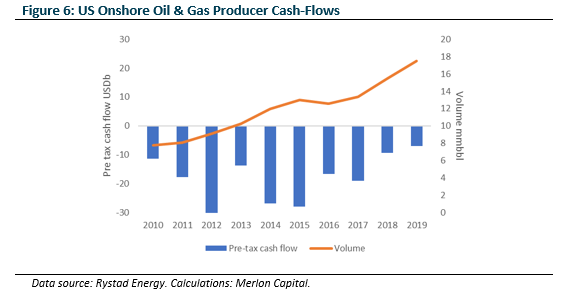

Yet it was estimated that roughly half of US onshore shale was already cash loss-making before COVID-19 (see chart below). This was before factoring in the need to drill 12,000 new wells required to maintain production, at a cost of USD85b. With this expenditure premised on oil prices above USD50/bbl, and capital markets drying up, this budget will be slashed.

Should this growth reverse, either due to persistence of capital discipline seen throughout 2019, or through the effects of COVID-19 low oil prices, we could see oil markets tighten. And in the case of LNG markets, declining volumes would see increasing contract negotiating power for incumbents ahead of sanctioning new projects. The ultimate conclusion will largely depend on the willingness of capital to re-enter and support a strong recovery of drilling.

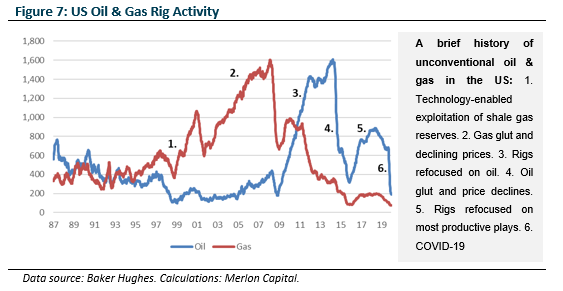

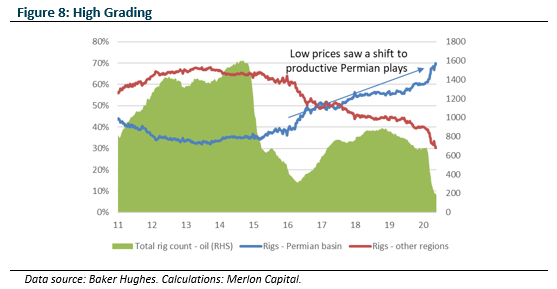

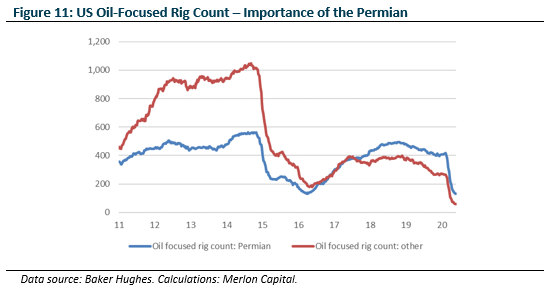

The precarious (or destructive) relationship between capital and returns has been exposed with the high-profile bankruptcies of Whiting Petroleum and Chesapeake Energy. The fact that Chesapeake has filed for bankruptcy, even after oil’s rally back above USD40/bbl, coupled with the more recent focus on more productive geology (see chart below), highlights the stress unconventional producers may be under. It is possible capital may permanently exit the US unconventional space given rig counts are close to historic lows, rig activity has already shifted to more productive plays (effectively high grading production) and OPEC+ is unlikely to allow second grab of market share.

The future of conventional oil

With the US unconventional oil industry under pressure, where to for conventional players? With the US having accounted for the majority of supply growth over the past decade, the focus is investing at a level sufficient to offset the natural 3-5% conventional field decline rates inherent in oil reservoirs. Prices have been too low since 2015 to incentivise any meaningful recovery in investment, with capital expenditure roughly 40% below peak levels, before factoring in 2020 cuts to spending. This underinvestment will be exposed if there is any sustained decline in US shale output.

On the basis of a return to pre-COVID-19 levels of demand, the combined effects of a crowding out of conventional investment, which have not recovered since the downturn in 2016, and the investment cuts expected throughout 2020 across the industry, are likely to result in a tightening of global oil markets over the medium term.

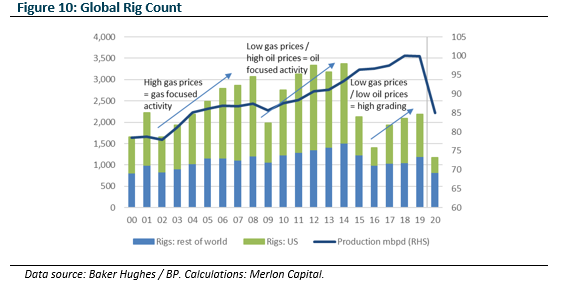

This underinvestment is visible in the number of active rigs outside of the US declining from 1,500 to around 1,000. This serves to indicate the relative importance of US activity in sustaining a normalised 100mbpd of oil demand.

And, in conclusion then, we return to the US, and the more recent concentration of activity in the productive Permian basin, which has, in turn, become the key support of US oil production. The geology and productivity of this Texas-based field has enabled production growth, even with lower oil prices, and using fewer rigs.

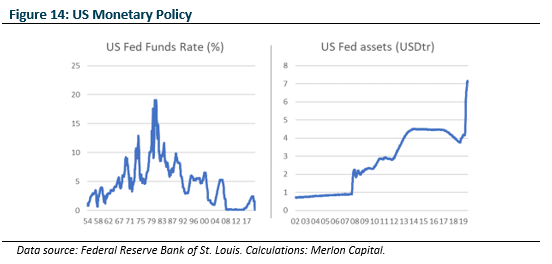

While it is possible that the abundant liquidity unleashed by the Federal Reserve results in a flow of new capital into drilling, rig activity was already elevated in the US well before the initial flood of capital from unconventional monetary policy following the GFC. In short, activity has been driven by prices, whether gas or oil, more so than cost and availability of capital. If enthusiasm for directing capital into drilling these fields does not return to drive a recovery in drilling in this key oil patch (see chart below), then US unconventional oil may have already peaked, and a growing reliance on an under-invested conventional oil industry may result in higher long-term prices.

The Merlon process and commodity stocks

At Merlon, we believe people are generally motivated by short-term outcomes, overemphasise recent information and are uncomfortable having unpopular views. Our process is aimed at ensuring we minimise our exposure to these behavioural biases and exploit misperceptions about risk and future growth prospects.

The first step in our process is determining sustainable free cash-flow, with reference to qualitative considerations, macro and cyclical considerations and financial returns with as long-term an historic context as possible.

Commodity exposed stocks generally fare poorly in terms of undifferentiated product, high capital intensity and pro-cyclical capital allocation track record. In 2018, we argued a quick resolution to the trade war was unlikely, but the more important driver was unfavourable long-term supply / demand dynamics in our most critical export, iron ore.

The second step is to determine an unbiased and consistent measure of value based on sustainable free cash flow and franking, net of debt. This allows us to determine whether there is some chance other investors have become too concerned (or complacent) about risks and growth.

We then shift our focus to conviction, which recognises that to be a good investment, we need evidence the market’s concerns are either priced in or invalid. One way we determine whether the market is overly pessimistic is to produce valuation scenarios focused on the risk of permanent capital loss relative to the best case or upside scenario. Again, commodity exposed stocks are well catered for in our process given the undifferentiated product and the long-term historical context available to assess a range of plausible valuation outcomes.

Merlon positioning summary

LNG (Overweight): The positions in Woodside Petroleum, Origin Energy and more recently, Oil Search, were established on the basis of an expected tightening of global oil markets over the medium term. Having been the primary driver of excess oil supply over the past decade, the current extreme price pressure is pressuring the US unconventional business model, resulting in US oil and gas rig activity declining to record low levels. Over the medium term we expect this to support prices and reduce the volume of US LNG exports. Over the longer term, we expect the underinvestment in conventional oil and gas assets, driven by the flow of capital towards unconventional assets, to reveal the effects of 3-5%pa natural decline rates. We have high conviction in this view because the market is overly focused on short-term demand disruption. As a result, even if we are wrong on the timing of the demand recovery, this is at least partly priced in relative to other commodities and equities.

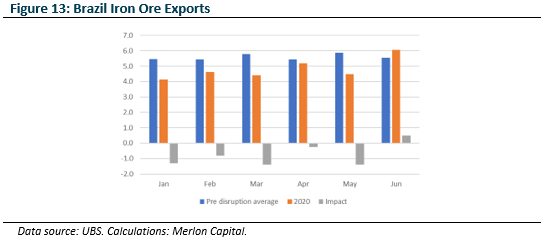

Iron ore (Underweight): Continued supply disruptions saw Brazilian exports down nearly 20% from average levels, supporting iron ore prices. Recent export data is showing signs of supply normalisation, which should see a looser market. Over the longer term, we also expect to see iron ore displaced as Chinese steel recycling rates increase – a well-accepted path in maturing steel industries. Given these risks, we do not hold iron ore producers.

Gold (Overweight): The position in gold, via Newcrest Mining, has been increased throughout CY20 as the ability of the US Federal Reserve to meaningfully increase ultra-low interest rates and reduce its balance sheet has become increasingly limited. While these unconventional policies were designed to be temporary, the ability to unwind in the context of growing geopolitical tensions between the US and China, and continued growth in debt levels restricts the ability to normalise.

Other: We also have smaller positions in copper, coal and more recently, alumina:

- Copper: Sandfire Resources (SFR) is a small, yet highly cash-generative copper producer, undervalued due to the market’s concern over its ability to extend its production beyond its core WA-based asset. The small scale of the company enables it to maintain productivity via exploiting high quality, but small scale ore-bodies globally which are of less interest to larger peers, who are struggling to find suitable projects to fulfil anticipated growth in demand.

- Coal: New Hope Coal (NHC) is undervalued by the market due to the perceived unattractiveness of coal-assets, coupled with the lack of investment in growth projects across the industry, in contrast with continued investment in thermal coal fired generation capacity. This dynamic is expected to manifest in tighter coal market over the medium term, with New Hope benefiting from the shift towards higher calorific-value coals as produced by Australia.

- Alumina: Alumina Limited (AWC) is a recent investment, having been sold down to attractive levels due to the effects of COVID-19 on the transport sector (particularly aviation). AWC is the largest supplier of alumina in export markets and occupies the bottom quartile of the global alumina cost curve.

Author: Ben Goodwin, Analyst/Portfolio Manager