Amazon Not Introducing Internet to Australia

Every day it seems the media is reporting how Amazon will destroy Australian retailers.

We are under no illusion that Amazon will take market share and reduce the profitability of Australian retailers. It would be foolish to think otherwise given that Amazon grew its North American sales by 25% to US$80b during 2016 and this remarkable growth shows no signs of abating. However, after reviewing key differences between Australia and other markets, we believe the impact of Amazon is being overplayed and continue to see excellent value in the retail sector.

Online retail is maturing

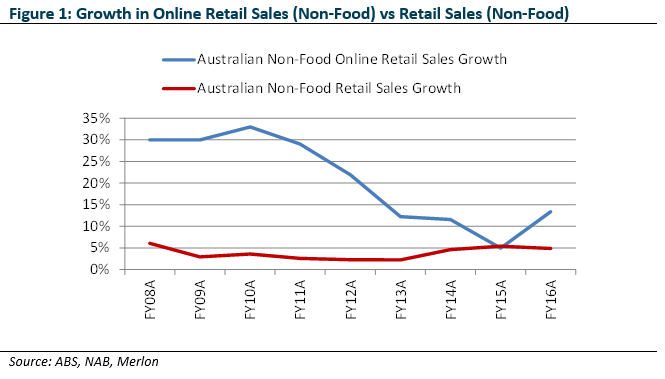

The growth of online retailing in Australia has slowed from around 30% pa up until FY11 to an estimated 13% in FY16 (Figure 1). In recent months this growth has fallen further to 7-8%. We believe the lower growth in recent years has partly been a function of the lower Australian dollar which has reduced the price incentive to purchase from international online retailers. Nevertheless, we expect Amazon’s expansion and the associated media coverage will see online sales growth accelerate.

Amazon’s Australian entry

It must be recognised that Amazon already has a market presence in Australia through the amazon.com.au site (Kindle) as well as export sales. While not disclosed, market estimates put Amazon’s sales in Australia at between $500 and $700 million. This obviously provides a good launching pad but also means at least initially that sales in Australia will somewhat cannibalise their current sales.

Amazon’s decision to expand in Australia at this time is closely linked to the upcoming introduction of GST for low value imports. Former Amazon executives have told us that until now Australia was considered to have been well serviced by Amazon’s other sites. With the change to the GST threshold, Amazon has lost an important competitive advantage and has therefore taken the view that it needs to establish a local presence to defend and grow its sales here.

Amazon is likely to start with Fulfilment Centres in Brisbane, Sydney and Melbourne. Amazon Prime (as discussed later) will likely commence within two years of entry as per the Mexico experience. Amazon ‘Prime’ memberships will be aggressively marketed following launch by heavily discounting the first year’s annual fee as was done in Italy.

Amazon’s competitive advantage and impact on industry structure

In assessing the impact of Amazon on the Australian retail sector, we draw on our investment process which places significant emphasis on industry structure and competitive advantage. We believe that high returns on capital and hence free cash generation can only be sustained through a combination of favourable industry structure and strong competitive positioning. Through our qualitative scorecard, we explicitly consider Amazon’s impact on industry structure and the competitive advantages enjoyed by the listed retailers.

Amazon will impact the industry structure of Australian retailing by reducing barriers to entry for niche retailers through its third party marketplace. The bargaining power of customers will also increase with increasing price transparency and product choice. On the other hand, it is reasonable to expect further industry consolidation as existing online operators become marginalised and weaker physical retailers exit.

Amazon also clearly possesses competitive advantageacross cost, product differentiation and service.

Amazon has a cost advantage by avoiding retail rents and store labour, both of which are high in Australia by global standards. Through its wide range and Amazon Prime, Amazon can fractionalise delivery costs relative to mono-line retailers.

Importantly, we do not believe Amazon will have a sustainable advantage sourcing branded products cheaper than large domestic retailers. Global suppliers will have no choice but to offer equivalent prices to local retailers and domestic warranties will remain important.

With regards to product differentiation, no retailer in the world can match Amazon’s range. Amazon operates in virtually all retail categories including fresh food and its US site is estimated to have approximately 500 million products for sale. It is able to achieve this principally through the use of its third party Marketplace that greatly enhances the range beyond what Amazon could stock alone.

Amazon’s ability to develop intimate relationships with its customers through bundling its offers and convenient fulfilment is perhaps its greatest source of competitive advantage. Through Amazon Prime, US customers qualify for free two day shipping on orders of at least $25 for an annual fee of $99. Amazon is estimated to have 60 million US households signed up to Amazon Prime and is rolling out similar services in other markets. This service is made even more attractive by the bundling of the Prime Video streaming service. Additionally, the Amazon Prime Now service enables free two hour delivery on a range of over 25,000 items. Same day delivery will threaten traditional retail profit pools generated from categories such as high margin accessories.

Retailers with large store footprints will need to compete on in-store experience and service, while utilising store networks for instore ordering and shipping to store for ‘click and collect’.

There is no doubt that the entry of Amazon will diminish the attractiveness of the retail industry structure in Australia and place pressure on incumbent retailers to cut costs, improve their propositions and strengthen their relationships with customers.

Contrasting the overseas experience with Australia

Amazon has been in the US, UK and Canadian markets for well over a decade. We have therefore studied these markets to gain a better understanding of Amazon’s likely impact in Australia.

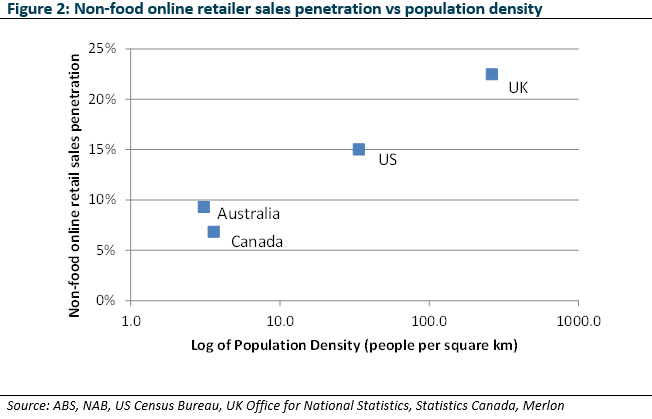

A key observation when comparing these four countries is that the success of not only Amazon, but online retailing in general, is significantly linked to population density (Figure 2).

As shown by the chart, non-food online retail sales penetration is highest in the UK, which also has the greatest population density. Correspondingly, penetration is lowest in Canada and Australia where density is lowest. Importantly, Canada’s official data excludes international online sales. Given Canada’s close proximity to the US, it is reasonable to assume that Canada’s penetration including international online purchases is in line or slightly above Australia.

This relationship is perfectly logical given that the more dense an area is, the faster and more cost effective it is to fulfil an online order (since there will be many other orders in the same area).

Sceptics will say that Australia is actually very dense on the east coast. But this is no different to Canada which has similar levels of density in its main cities along the southern border to the US.

Linking this back to Amazon, it has clearly struggled in Canada. Amazon entered Canada in 2002, later launching Consumer Electronics in 2008 and remaining categories in 2010. While Amazon does not disclose its Canadian retail sales, we can infer from its segment accounts that it is doing at most US$2b of sales (excluding third parties) out of a total Canadian retail market of US$320b. This pales in comparison to Amazon’s US retail sales of approximately US$78b. Even adjusting for lower population, Amazon has not been nearly as successful in Canada as it has been in the US and has admitted as such.

US sales tax arbitrage helped in the early years

Sales tax is an important feature of Amazon’s US experience that will not be replicated in Australia. For many years, Amazon enjoyed an enormous free kick because it was not required to collect state and local sales taxes in states where it did not have a physical presence (for example, a fulfilment centre). For example, in 2011 it only levied these taxes on sales from five states. This gave it a distinct price advantage over its store based competitors where state and local government taxes can quickly add 7-10%. Today, Amazon collects sales tax in all 45 states with a sales tax regime but this was mostly addressed only this year. At this point it’s a non-issue in the US given the scale and customer acceptance that Amazon has already achieved. Clearly though, Amazon’s growth in Australia will not benefit from the same circumstances since it will be required to collect the 10% GST from day one.

Convenience of delivery will be another challenge for Amazon. Missed deliveries will either incur a costly redelivery or force the customer to collect from the Post Office, Courier Depot or other pick-up point. This is a much poorer customer experience than very dense US cities like New York, where some customers can simply collect their delivery from their doorman as they return home.

Impact on retail sector stocks

Given Australia’s similarities to Canada and differences to the US, we expect it will take longer than many expect for Amazon to have a meaningful impact on the Australian market. Nevertheless, Australian retailers will lose share and endure margin pressure as Amazon expands, but the extent will vary by category and competitive position of individual retailers.

Established pure play online retailers will be among those first impacted. Clearly, eBay will be challenged since it is most comparable to Amazon domestically (particularly with respect to Amazon’s Marketplace). In the US, Amazon dwarfs eBay and we therefore expect Amazon will eventually overtake eBay here.

In terms of individual retail categories, Amazon’s success will be linked to the extent of service and importance, or lack thereof, of in-store experience. Amazon does best in categories that have products with low service requirements and that are easy to ship in a box. While there is very little sales mix data available for Amazon, it is true to say that its market shares are highest in Media, Electrical, Sports and general merchandise. On the flip side, it has very low share in large whitegoods (approximately 1% in the US), furniture, Auto and grocery.

From this perspective, we also see Department stores as being significantly impacted by Amazon’s entry. In the US, this category has been contracting for the last 10 years with store closures now accelerating. Of particular note is Kmart, which has very high margins and very low prices. Ironically, these low prices make the shipping cost far more significant and will be at high risk once Amazon Prime launches with free one or two day delivery.

In-store experience needs to improve and costs need to come down

One of Amazon CEO Jeff Bezos’s famous quotes is “Your margin is my opportunity”.

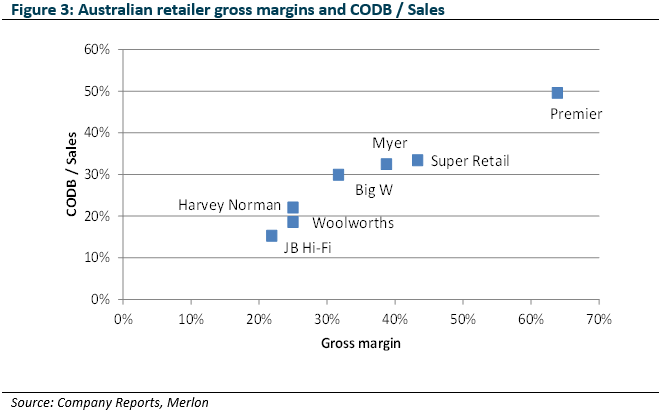

On a stock level, we consider the retailers at most risk from Amazon are those that exhibit both high levels of gross margin selling commodity products and high costs of doing business (CODB). Retailers with these characteristics may very well find their lunch cut by Amazon through its low price strategy and low operating costs. Given this, we have plotted a subset of Australian retail stocks using these two metrics (Figure 3).

JB H-Fi is well positioned to compete with Amazon given it has both a very low gross margin and low operating costs (which is partly a function of its very high sales per square metre). On the other hand, retailers such as Super Retail, Myer and Big W face more challenges because both their gross margins and cost bases are substantially higher than Amazon’s (which we estimate has a retail gross margin of 22-25% and a retail CODB / sales of approximately 15-20% of sales). While Premier stands out as most exposed on these metrics, it sells its own products not available elsewhere. Furthermore, its Smiggle and Peter Alexander brands are particularly differentiated in the marketplace.

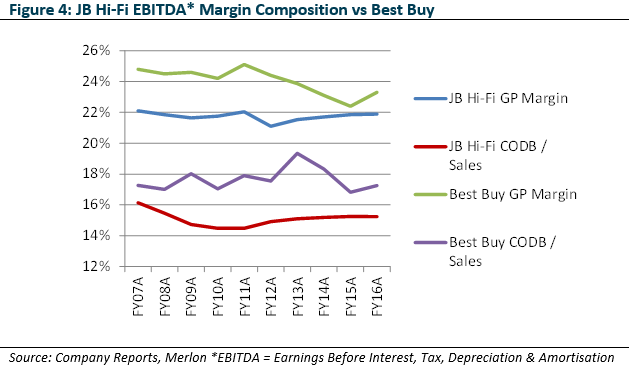

We have also compared JB Hi-Fi and Harvey Norman to offshore electrical market retailers Best Buy (US) and Dixons Carphone (UK). From this, we expect that JB Hi-Fi and Harvey Norman can each hold sales and earn reasonable margins after a period of adjustment given the experience of both Best Buy and Dixons Carphone. For example, Best Buy took a hit to profitability in 2013 but started with a higher gross margin and CODB / Sales than JB Hi-Fi has currently, meaning that JB Hi-Fi is comparatively better positioned (Figure 84). In any case, Best Buy’s margin has since largely recovered.

Underscoring JB Hi-Fi’s low gross margin, our sampling of prices by electrical category suggests that the differential in pricing on Amazon’s US website to JB Hi-Fi (when adjusting for GST and currency) is minimal aside from a few categories such as Accessories, Headphones and AV receivers. In the case of the latter two categories, we believe this is mostly a function of suppliers charging more here because they can but we expect these suppliers will be forced to adjust their pricing to better reflect US prices.

From a category perspective, while Amazon is the number two player in US electronics, JB Hi-Fi’s recent acquisition of The Good Guys and Harvey Norman’s exposure to whitegoods and furniture (approximately 40% of sales) should offer some insulation given Amazon’s miniscule (1%) US Appliances (Kitchen/Laundry) share. We also expect both JB Hi-Fi and Harvey Norman to benefit from further consolidation, with Department stores most likely to exit this category as well as smaller, sub scale electrical players. In any case, Harvey Norman’s international businesses and conservatively valued commercial property portfolio will also act to buffer any impact from Amazon on its Australian franchise operations.

With regard to Supermarkets, Amazon’s recent acquisition of Whole Foods in the US is evidence that Amazon Fresh will be a premium rather than price-led proposition. This supports our view that bricks and mortar is critical to any omni-channel strategy and plays into the strengths of Woolworths and Coles. Amazon has been dabbling in physical retailing since 2015 although to date focused on bookstores and showcasing its own gadgets.

Finally, we believe that retail Real Estate Investment Trusts (REITs) will need to reduce rents over time to enable retailers to better compete with Amazon. Clearly, a specialty retailer with rental expense representing 25% or more of sales will struggle to be able to match the pricing of Amazon whose total costs to sales is below that. While the market has started to price this into retail REITs such as Scentre Group, we believe it is still not fully priced in.

A lot is already factored in

Merlon’s investment philosophy is built around the notion that companies undervalued on the basis of sustainable free cash flow and franking will outperform over time. That said we also believe that markets are mostly efficient and that cheap stocks are always cheap for a reason. It follows that we are focused on understanding why cheap stocks are cheap. To be a good investment, market concerns need to be already priced into the current share price or deemed invalid. We incorporate these aspects with a “conviction score” that feeds into our portfolio construction framework.

As discussed above, our qualitative scorecard provides a vantage point from which to consider Amazon’s impact on the retail industry structure and the competitive advantages enjoyed by incumbent players. This qualitative assessment weighs into our projected growth rates and sustainable cash flow estimates for the retail stocks that we cover. For JB Hi-Fi and Harvey Norman we have modestly trimmed our estimates of sustainable free cash flow in recent months on the basis that their growth and margins will be impacted by Amazon but on balance think that they will still remain strong, viable businesses.

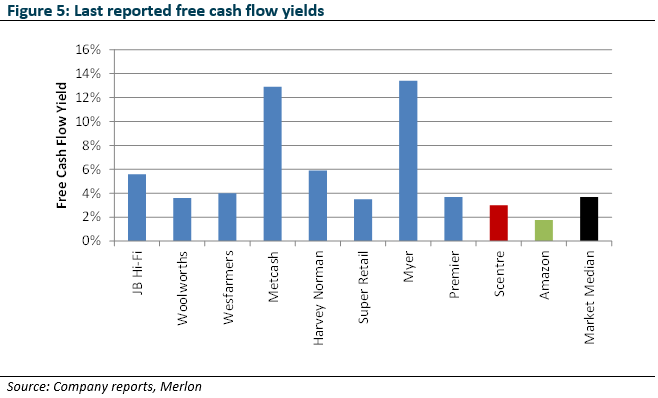

It follows that we believe the market has become overly pessimistic. Since 4 November 2016 when Amazon’s expansion was first speculated in the press to 30 June 2017, discretionary retailers such as JB Hi-Fi, Harvey Norman, Super Retail and Myer have underperformed the ASX200 by between 23% and 36% resulting in relatively high free cash flow yields (Figure 5). The supermarket stocks have understandably held up better given their strong grocery businesses and Wesfarmers’ diversification in Hardware and Coal etc.

Rather than the entry of Amazon, we view elevated housing prices and highly indebted consumers as the most significant issues facing the listed retailers. As we discussed in our March quarterly, we think house prices are modestly overvalued but not to the extent many commentators suggest. Further, household savings rates are historically high and balance sheets historically strong which somewhat tempers our concerns.

We retain positions in Harvey Norman, JB Hi-Fi, Wesfarmers, Woolworths and Metcash but have no exposure to retail REITs, Super Retail or Myer.

Author: Adrian Lemme, Analyst/Portfolio Manager